The Amazon Clothing Store marks yet another move in the direction of fashion’s online destination, and it has created a huge sense of concern in the industry. First, as the 5th largest most-visited site (after Facebook) it’s got a following, whether people actually buy there or not. Among youth culture today, Amazon is synonymous for being a main online shopping destination.

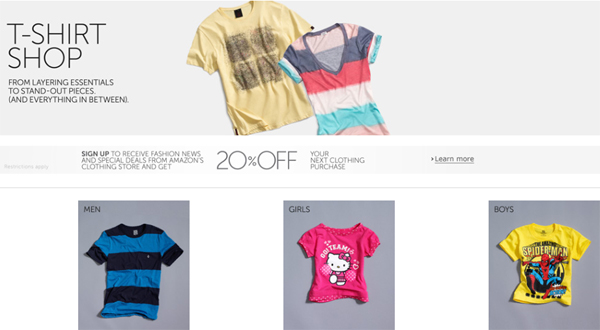

Known for books mostly, the giant online retailer launched a slew of high-end ads in top fashion magazines to announce the Amazon Clothing Store in March and April. Zappos, a popular online shopping destination for youth culture, is a part of the Amazon company, having been purchased in 2009, and will benefit from Amazon moving more heavily into the online fashion space.

Amazon was also seen at the last set of trade shows, from MAGIC to Agenda, and store carry’s brands from high-end Betsy Johnson to streetwear friendly Volcom. But there’s more. They also have a strong B2B platform whereby online retailers like Karmaloop can also sell their wares.

In our Spring Youth Culture Study 2012, we devoted an entire section to the changing shopping patterns of young people ages 13-25-years-old. Online shopping for Clothing is an increasingly important category and the top online retailers in this space, including popular stores that also have an ecommerce component, have more competition than they may realize.

For example, as our data and analysis show, as more young people shop vintage and thrift—a circumstance based on a souring economy coupled with new discovery of mixing and matching retro eras–sites such as eBay pop higher on the radar.

Putting it another way, as we once stated at a conference where it was clear that brands like Quiksilver and Billabong more often looked at each other as the “competition” than the real gorilla in the room, i.e. Hollister, it’s important in this case to see the landscape for what it is. Volcom, for example, may be competition in the action sports apparel landscape, but a bigger factor is Forever 21 and the growing popularity of H&M.

Moving online, while its vitally important for brands working within youth culture today to have a strong ecommerce platform and direct-to-consumer strategy, it’s also important to note the real behemoths that will take up space in the playing field, and the latest is Amazon.

For more information about subscribing to our Spring Youth Culture Study 2012, contact info@labelnetworks.com.